10 Important Financial Decisions in Your 30s with Helprin Management Tokyo Japan

You may wonder how people gain millions without generational wealth to help them build their riches. The secret lies in discipline, risk-taking, and intelligent money decisions. You don’t need to have millionaire parents as long as you make sound judgments on your finances with perfect timing.

Your thirties are the best years to practice critical fund accumulation and management skills to prepare for your future. This article will discuss the necessary money-related activities you should be doing during this decade.

Here are ten crucial financial actions you should be making in your thirties:

1. Plan your finances

There’s a saying that you can’t control what you can’t measure, so the first step is to measure and plan your finances thoroughly. A financial plan should be the foundation of your entire 30s money strategy.

Here are the steps to planning:

- Outline your money goals for the month, quarter, and year. Make sure it’s specific, measurable, attainable, realistic, and time-bound. To test for attainability and possibility, you should do the following steps.

- Compute your consistent net total monthly income. If you’re a freelancer, use the lowest monthly amount as your baseline.

- Track what you spend from essentials (utilities, mortgage, bills, work allowance, tuition, etc.) to luxury (shopping, cosmetics, accessories, vacation, etc.).

- Create a 50/30/20 budget: 50% for needs, 30% for wants, and 20% for savings or debt repayment. For example, if you have a $5,000 net monthly income, allocate $2,500 for needs, $1,500 for wants, and $1,000 for savings, investments, and debt repayment.

- Review your plan from time to time.

A plan will help you track your money better and save more from your income. Helprin Management Tokyo Japan is a company that helps clients manage their money better and allocate some for the future.

2. Make an emergency fund

An emergency fund prepares you for calamities, disasters, or instances when you can’t work. As a general rule, the emergency fund should be as little as six months to a year’s worth of income. Your emergency fund will help you recover in case your experience any losses.

3. Spend less than what you earn

This advice may seem like a no-brainer, but you’d be surprised how many people fall into excessive debt because they can’t sustain their lifestyle. Stay within your budget so you won’t fall into evil debt traps from loan sharks. Don’t live from paycheck to paycheck, if possible.

4. Get professional financial advice

Financial advisers and managers from companies like Helprin Management Tokyo Japan can offer several services that would benefit you in the long run. These experts can help you decide what to do with your savings, especially if you’re preparing for your family’s future.

Here are some services they can offer:

- Financial planning

- Investment management

- Retirement

- Real estate handling

- Charity coordination

- Insurance

Financial professionals may also help you get more innovative business tax strategies and benefits.

5. Invest in things that appreciate in value

Beginners make the mistake of buying high and selling low by purchasing items that eventually depreciate. Smartphones and cars (unless they’re vintage) are some items that quickly lose their value as soon as you purchase them.

6. Pay off your debt

You can’t start saving money until you get rid of all your debts like student loans, credit card bills, etc. However, not all loans or obligations are wrong; some are good and have the potential for higher gains in the long run. Focus on paying off the bad debts.

Here’s a popular debt repayment technique:

- List all your debt details: principal amount, interest terms, and balance.

- Set a budget for debt repayment: 10 to 20% of your monthly net income.

- Start by paying off all of the monthly interest first, then putting the extra from the debt repayment budget to the one with the highest interest until fully paid.

- Continue with the same budget even when you have already paid some debts until you eliminate every single debt.

Once you pay off all your debt, you can start saving for the future.

7. Simplify your lifestyle

Simplifying your lifestyle means adjusting your 50/30/20 needs/wants/savings budget and reducing or removing the wants. You can increase the money you allocate to savings and debt repayment or investment when you’re debt-free. Even something as simple as making meals at home will save you hundreds of dollars a month.

8. Expand income sources

You may look at the #1 item on this list (financial plan) and realize you can’t afford your needs with your current income, which means you need another revenue source or passive income to make money while you sleep.

Here are some income source ideas:

- Real estate rentals

- Monetize your identity, skills, and experience through content creation like blogging or vlogging

- Create a business

- Part-time jobs

- Freelance gigs

A sole income source will get you in trouble long-term, especially when you get sick or cannot perform your job or function.

9. Diversify investments

There’s a saying that you shouldn’t put all your eggs in one basket because the basket may fall and break all your eggs. Investments come with substantial risk, and most markets are prone to crashing, so you need to be careful where you put your funds.

If your portfolio only consists of one type of investment like real estate, cryptocurrency, forex, stocks, etc., you have a greater risk of busting out when the respective market crashes. Therefore, you should spread your money across different platforms.

10. Prepare for retirement

Lastly, it would help if you planned for retirement to live comfortably in your later years. Some people fail to prepare for retirement and end up working until they’re 60. Calculate how much you need to retire. Fortunately, many sites offer retirement calculation computations considering factors like inflation, social security, and life expectancy.

Bottomline

Most people leave their twenties with debt and destructive monetary decisions since schools don’t often equip graduates with sufficient economic know-how. Helprin Management Tokyo Japan promotes intelligent financial investment and management decisions so that you can retire comfortably without apprehensions.

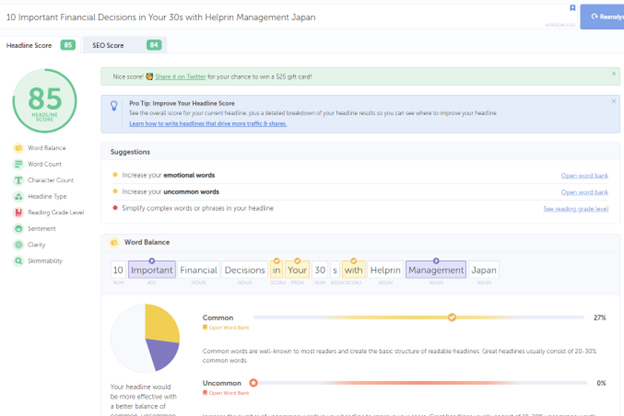

Coschedule Headline Analysis:

Headline score: 85

SEO score: 84