Comprehensive Guide to Retirement Planning with Helprin Management Tokyo Japan

It’s easy to get lost in the now. People say you only live once or seize the day like there’s no tomorrow. Unfortunately, being irresponsible and only partying in your early years will leave you vulnerable once you’re at your retirement age. You should still take small steps to create the life you want after you retire.

These are the steps you need to plan your retirement:

Calculate how much you may need

The first step to planning your retirement is creating an estimate of how much you need to comfortably live the rest of your life, starting from a specific age. Of course, this process is purely hypothetical since you won’t know how much you need until retirement.

Here are some of the considerations and computations:

- Retirement years – computed as the number of years from the age you want to retire until a hypothetical life expectancy rate.

- Monthly expenses – outline your cash flow according to what you currently need and what you think you might need during retirement.

- Inflation rates – inflation rate is the percentage that prices increase over time, usually annually.

Financial firms like Helprin Management Tokyo Japan will help you develop the ideal amount, so you don’t need to make computations yourself.

Supplement your social security

Social security is a great way to secure your retirement age, but it will not be enough due to inflation and various loans. You must expand your social security amount with savings and an excellent long-term investment portfolio developed by financial professionals.

Minimize spending

After assessing your financial flow, you need to take steps to minimize your expenses to improve your money accumulation. You may ask experts like Helprin Management Tokyo Japan for advice on reducing expenditures and sticking to your budget.

Clear high-interest debts

Loans and debts are essential to growth and progress, but you should clear the high-interest ones while you’re still capable. Most banking institutions offer low-interest rates on car or home loans so you can take care of them last. Pay off your debt starting from the highest interest rate until you eventually clear all of them.

Be more tax-efficient in your investment diversification

Diversifying your investments allow your funds to overcome possible market crashes and dips. The more variety you have in your portfolio, the better it’ll fare in the long run. Aside from diversity, you need to consider the taxes and how they affect your entire portfolio.

Here are some of the retirement-ready investments you should have in your portfolio:

- IRA or 401(k)

- Real estate

- Stocks

- Gold

- EFTs and Index funds

- Cryptocurrency

- Bonds

- Annuities

Getting financial managers like Helprin Management Tokyo Japan lets you know about your tax-efficiency options from professionals in the industry.

Takeaway

It’s never too early to plan your retirement years; your prime years are great for accumulation and savings. Retirement planning will allow you to work towards a goal as soon as possible. Financial managers offer the best advice for clients preparing for much-needed relaxation with a strong portfolio and several investment vehicles guaranteed to provide long-term profit.

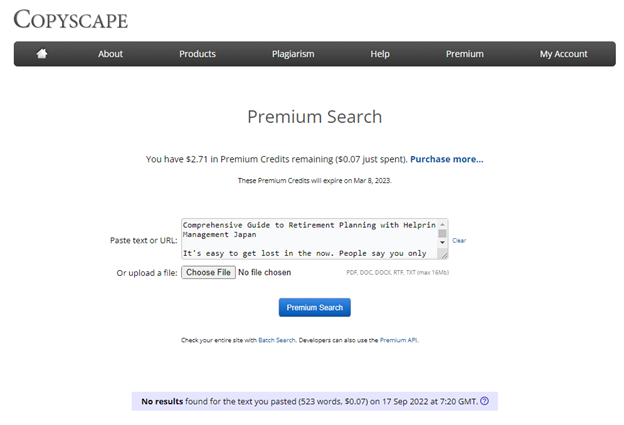

Plagiarism check: